Potash News 2021-12-01

Potash dynamics in Saskatchewan:

Saskatchewan Potash Company Stock Quotes:

Nutrien Ltd.:

(NTR, TSX: $84.56 Canadian dollars per share, a decrease of $0.12 Canadian dollars, a decrease of 0.14%).

Mosaic:

(MOS, NYSE: $33.62 per share, a decrease of $0.53, a decrease of 1.54%).

International Potash Fertilizer News:

Trigg Mining:

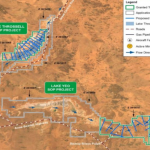

Trigg Mining Company will look for more potash fertilizer resources in Western Australia. After being granted two new exploration rights, the company is conducting ground exploration activities for the new potassium sulfate project.

The newly acquired mineral rights cover the eastern half of the Lake Yeo project area, about 65 kilometers southeast of Trigg Mining’s flagship Lake Throssell potassium sulfate project.

The first gravity survey has been launched to begin testing the hypothesis that Lake Yeo and Lake Throssell are potentially the same ancient river valley. The purpose of the survey is to identify ancient river valleys and determine drilling targets.

Trigg Mining Company described the new project as an "exciting growth and expansion opportunity."

Keren Paterson, Managing Director of Trigg Mining Company, said: “The granting of the Lake Yeo mineral rights is an important step in assessing the broader potential of the potassium sulfate mineralization area close to Lake Throssell – we believe the potential is very important. Success, this may be a transformational development that has led to a dramatic expansion of our growth pipeline in the region, around a central potassium sulfate processing center in Lake Throssell."

According to Trigg Mining Company, the brine that Lake Yeo may collect is of similar grade and composition to Lake Throssell. It is estimated that the total amount of drainable mineral resources in the lake is 14.4 million tons, and the potassium content per liter is 4665 mg (or Potassium sulfate 10.4 kg per cubic meter), in addition to exploration targets.

The company recently released an aggressive scoping study to position Lake Throssell as a potential low-cost, one of the top 10 global potassium sulfate producers. Highlights of the study include a net present value of 364 million U.S. dollars and a nameplate production target of 245,000 tons of potassium sulfate per year over the mine’s 21-year life cycle.

At the same time, a filling gravity survey is being carried out at Lake Throssell to refine the location of the test water holes, as part of the next phase of the current pre-feasibility study for drilling. This work is expected to support the transformation of mineral resources into ore reserves.

Ms. Paterson said: "The current dense gravity project at Lake Throssell marks the official start of the pre-feasibility study, which will help identify potential resource expansion and help refine the pilot production boreholes that are expected to be drilled in mid-2022. Planning.".

Uralkali

Uka (Company), one of the world's largest potash fertilizer producers, announced that the company's board of directors passed the following key resolutions at the meeting held on October 27, 2021:

Held Uralkali's Extraordinary General Meeting (EGM) on December 1, 2021 to consider matters such as the payment of dividends for the first nine months of 2021;

Recommend to the special general meeting of shareholders to pay dividends on the issued preferred shares of Ukala in currency. The amount of preferred shares of the company is 2,055 rubles per share, instead of paying dividends on the issued common shares of the company.

The board of directors also proposed to the extraordinary general meeting that the date for determining those eligible for dividends be December 12, 2021.

Wuka’s share capital includes 1,268,585,999 ordinary shares and 30,000,000 preferred shares purchased by shareholders.

Domestic potash fertilizer trends:

Potassium chloride fluctuated, and the price trend analysis of potassium chloride in the near future

The domestic market price of potassium chloride fluctuated alternately. Statistics show that in terms of the wholesale prices of domestic potassium chloride in various provinces, prices in Jiangxi, Shandong, and Xinjiang have increased by 5-100 yuan/ton on a week-on-week basis, while prices in Anhui have dropped by 5 yuan/ton on a week-on-week basis, while prices in other regions have remained stable; imported potassium chloride In terms of wholesale prices in various provinces, prices in Heilongjiang, Hunan and Jiangxi increased by 40-200 yuan/ton on a week-on-week basis, while prices in Shandong dropped by 50 yuan/ton on a week-on-week basis, while prices in other regions remained stable.

Potassium chloride market supply situation

In terms of domestic potassium, the Salt Lake Group reduced production, normal delivery, and reduced regional supply. The mainstream transaction price was around 3750 yuan/ton, which was an increase from the previous period; Qinghai's small plant started at a low level, with 57% content in short supply, and few available for sale. Spot goods. In terms of imported potassium, the port arrival volume is small, and the supply continues to be tight. Refer to the mainstream quotation 62%. The Russian white potassium port quotation is about 4080~4100 yuan/ton. The low-end price has increased by 30 yuan/ton from the previous week, and the high-end price has remained stable. . In terms of border trade potassium, the market is very bullish, with 62% Russian white potassium at around 3900 yuan/ton, an increase of 100 yuan/ton from the previous week.

Potassium chloride market demand

The winter storage of potassium chloride market is progressing slowly, distributors are not very motivated to stock up, and demand release is slow. Downstream compound fertilizer manufacturers purchase raw materials on demand, and the overall operating rate of compound fertilizer companies is around 34%.

International potassium chloride market performance

International potassium chloride prices continue to rise. In terms of price week-on-week, the low-end FOB price of potassium chloride in Vancouver rose by US$22/ton, and the high-end price rose by US$23/ton to US$526~731/ton; the low-end FOB price of potassium chloride in Northwestern Europe rose by US$24/ton. Tons, the high-end rose 11 US dollars/ton, to 482~742 US dollars/ton; the low-end Baltic potassium chloride FOB price rose 24 US dollars/ton, the high-end rose 11 US dollars/ton, to 472~735 US dollars/ton; Israel chlorination The low-end FOB price of potassium rose by US$27/ton, and the high-end price rose by US$11/ton to US$561~758/ton; the CIF price of potassium chloride in Southeast Asia rose by US$20/ton for the low-end and US$5/ton for the high-end. US$600-625/ton; the CIF price of potassium chloride in Brazil rose by US$15/ton for the low-end and US$10/ton for the high-end, to US$800-810/ton.

Potassium chloride market outlook forecast

The current domestic market demand for potassium chloride is weak, and compound fertilizer manufacturers mainly purchase raw materials on demand. The start-up of potassium chloride production enterprises dropped slightly, and the quantity of goods arriving at the port was relatively small. From January to October 2021, the import of potassium chloride decreased by 750,000 tons year-on-year. Recently, the price of potassium chloride in the international market has continued to rise. It is expected that the domestic potassium chloride price may rise steadily in the short term, and it is necessary to focus on the international market and the arrival of goods.

(Source: China Agricultural Material Circulation Association)